|

| As a new financial year dawns, independent experts now agree that Sydney's home values are growing. |

Improved equity market conditions in 2013 had led to an increase in dwelling values in Sydney’s prestige suburbs. The strength of the Sydney market was due to a sustained period of underbuilding, which had led to low vacancy rates and strong rental growth since 2007. Large numbers of investors were flooding the market. Low interest rates were also helping.

‘‘Sydney’s most expensive suburbs have seen dwelling values

rise by 4.8 per cent over the past six months compared with a 3.2 per

cent rise in values at the most affordable end of the market and a 4.6

per cent gain across the broad middle-priced segment of the Sydney

market.”

"The Sydney residential market now appears to be gaining some momentum after being weak for the best part of the last decade,"

"We are forecasting total price growth in Sydney over the three years to June 2016 to be 19 per cent, or a moderate 5.9 per cent per annum."

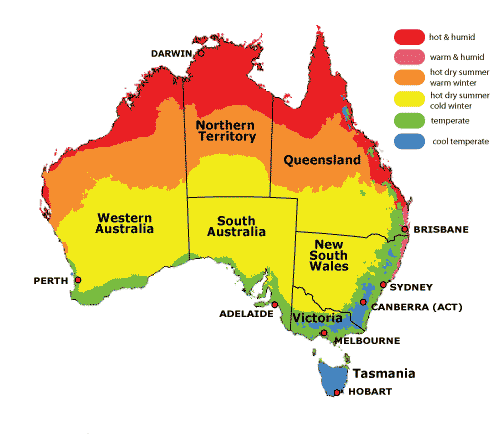

Some information/opinions about our states:

MELBOURNE: Less optimism going around because of an oversupply of apartments and weakness in the local economy.

"Median house price growth in Melbourne is forecast to be minimal, totalling 5 per cent over the 2013 to 2016 forecast period," "And accounting for inflation, prices are actually forecast to fall by 4 per cent in real terms."

BRISBANE: By the end of 2015-16, rising interest rates will begin to impact on prices, but only after a forecast total rise of 17 per cent in the median house price over the three years to 2016, representing an average rise of 5.2 per cent per annum,"

PERTH & DARWIN: About 15 per cent growth is forecast for the three years in Perth and 10 per cent in Darwin.

CANBERRA: Total rise of 3 per cent (a decline of 5 per cent in real terms)

HOBART: A rise of 4 per cent (a drop of 5 per cent in real terms)

ADEALAIDE: 6 per cent growth (or a 3 per cent decline in real terms).

No comments:

Post a Comment